Corporate executives are always buying and selling stocks from their company. This practice is known as insider trading. The executives often have more information than the public concerning the performance of the firm. However, this does not mean that other investors are left out. Individual investors can seek insider trading data and used it to their advantage. Here are a few tips on how to analyze insider trading data.

1. Who is buying the stock?

Some insiders are more informed than others. The CEOs and CFOs are more likely to have more information about the company than other employees. These executives know more about the company’s status and where it is headed. Therefore, seeing the CEOs buying stocks in the company might be a hint for the right direction. However, this strategy might mislead you if the CEO is new and does not know much about the firm.

In large companies, crucial information is well known to the executive only. However, in the small-medium enterprises, all insiders are conversant with the financial status of the company. Therefore, it is likely that insiders in the small companies will give you a better hint on whether to invest in the firm or not. Therefore, the question, “who is buying the stock?” is necessary to track insider trading.

2. What is the timing of the purchase?

The timing of the stock purchase is also an indicator to be considered. Most insiders will make their purchase if they have a feeling that they will benefit from the investment. Therefore, seeing many insiders make their purchases around the same time should send some signals. Having these insiders make their purchases around the same period every year should indicate that that is the best earning season.

3. How much is being traded?

Corporate executives can sell the wrong perception of the company’s status. CEOs and CFOs will not move around, saying that the company is about to run bankrupt. No, the business leaders will look for more luring ways of attracting more investors to save the company. Therefore, the executives can decide to purchase the company’s stocks. This action will often paint the picture to other investors that the company is doing well, leading them to make more investment.

Therefore, it is essential to ask yourself, how much are these insiders trading? No one will risk a tremendous amount of money to an investment on the edge of collapsing. Therefore, if there is a sudden change in the number of trades the insiders are making, it is wise to seek more clarification.

Also, having many insiders suddenly making their trades might be a good insight than seeing one. Having many trades taking place is a good indicator; thus, you should consider analyzing that too.

4. Leaving room for the unforeseen

Insider trading data often seem to provide some indicators on the stock market direction. However, individual investors ought to be careful when analyzing these signals. Some of the indicators might be misleading; it is always good to do some background checks.

A prominent insider, such as the CEO purchasing stocks could be a sign. However, the unexpected happens and things can fail to go as planned. Investors should avoid treating the hints as a sure-pointer of the market.

5. Staying on track

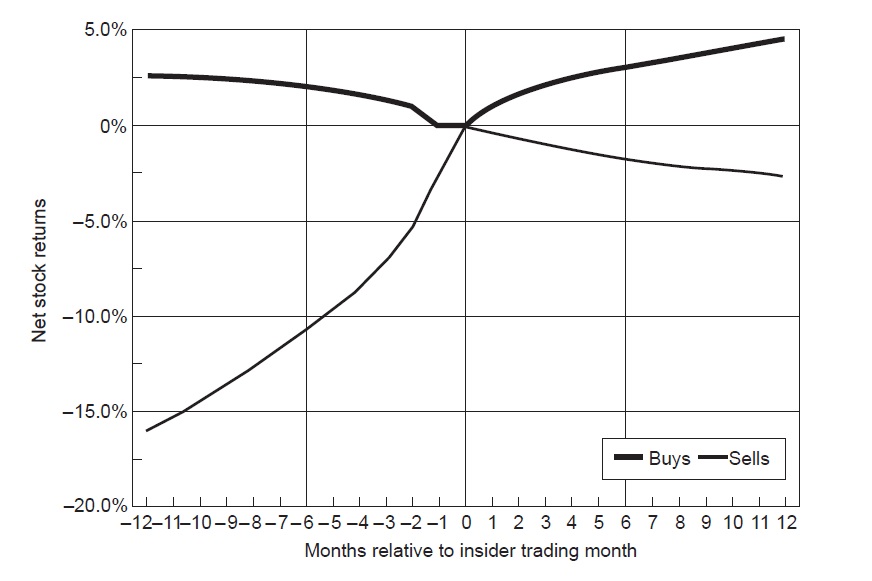

Most insiders will act on their purchase based on the extra information they have about the company. However, to avoid their investment being termed as illegal insider trading, they act in advance. Some studies show that the insiders might act as early as two years before the information is released to the public. Such strategies might be hard to identify as an indicator. Therefore, while analyzing insider trading as an individual investor, you should consider that strategy.

However unpromising such a strategy could seem, learn to be patient—the insiders could be right. However, it would help if you also understood that insiders could make their selling decision based on their issues. One could be looking for some urgent cash or finding a better place to invest it. Therefore, always do some more research before acting on an indicator.

Insider trading data is not a new concept. However, analyzing the data can be tricky since companies have many insiders. Sometimes, the interpretation of the data can mislead you. Therefore, it is advisable first to complete your routine company analysis then consider some of the indicators.