In the Philippines, many Filipinos equate success to having their own house. When an individual incurs this significant investment, they feel prosperous in life. Moreover, as this is an enormous investment, it is vital to protect it from risks or damages stemming from unexpected events or catastrophic hazards. And ensuring the property is one way of protecting it.

The importance of home insurance Philippines is evident in the country, as it is in any other country or state. The Philippines is located along the Pacific Ring of Fire, making it prone to natural disasters. It has seen many properties damaged and homes destroyed thanks to typhoons, among other calamities.

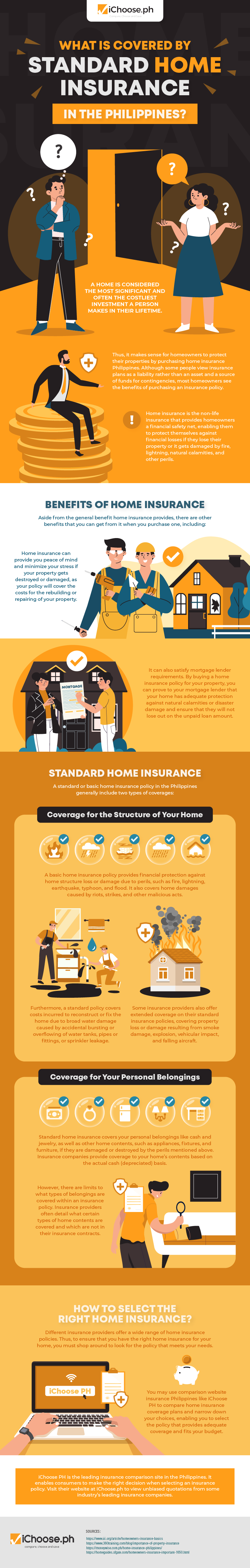

Hence, having a home insurance policy in the Philippines helps homeowners financially securetheir property investment. This insurance enables them to recover after experiencing devastating consequences or paying for damages from adversities, such as natural disasters and various weather events.

With protection against financial losses, homeowners can have peace of mind and minimize their stresses about facing financial hardships when their property incurs damage. In addition, a house insurance Philippines policy also covers personal belongings, such as cash, jewelry, appliances, fixtures, and furniture.

Furthermore, by acquiring a home insurance policy, homeowners can have higher chances of having their home loan approved, as mortgage lenders will prove that they have adequate protection for the said property. This means that the lenders will not lose out on the unpaid loan amount if the house incurs damage due to a natural calamity or other unforeseen events.

However, even when it is highlighted that having a home insurance policy can protect homeowners against financial ruin, many people are still overwhelmed when they hear about this insurance and hold themselves back from purchasing one. This is because they think home insurance is a waste of money.

But people fail to realize that a home insurance policy is only a waste of resources if they purchase one without determining the coverage inclusions and limits. Even with a standard home insurance policy, you can get adequate protection. For more information about the coverage offered by a standard home insurance policy, see this infographic from iChoose.ph.